About Us

We invest where objective fundamentals meet subjective insight.

We create value through thematic conviction and operational rigor. We acquire, invest, and manage real estate on behalf of institutional and high net worth capital.

Our mandate is to pursue opportunistic acquisitions in segments of the market that are underserved or overlooked—where complexity creates opportunity and disciplined execution delivers strong, risk-adjusted returns.

High Art was founded by experienced investors with backgrounds spanning institutional capital markets, private equity, and real estate operations. The firm operates with a long-term orientation, prioritizing repeatability and alignment with our partners over transaction volume.

Our Approach

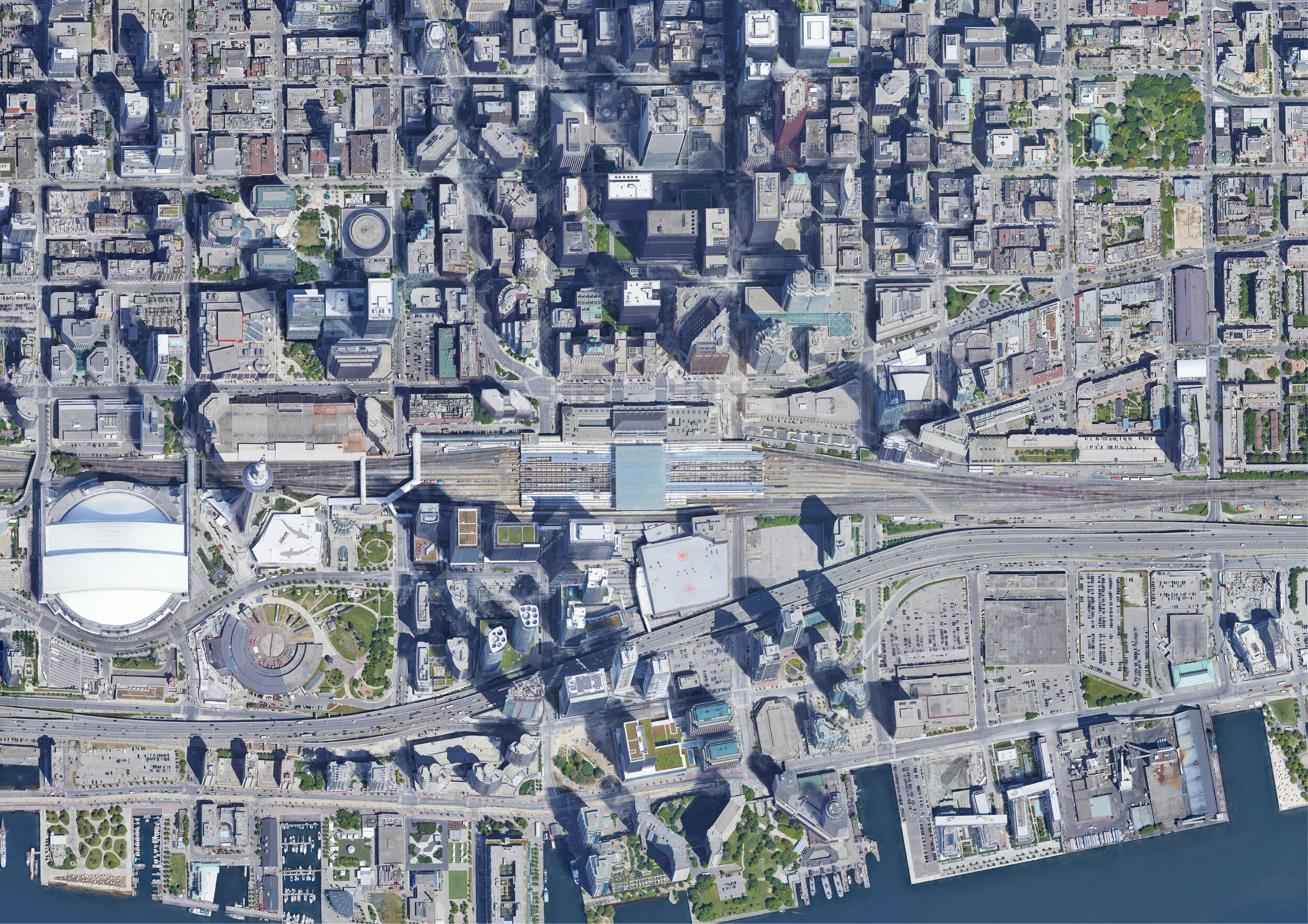

Our current focus is the scaled acquisition and professional management of condominium units across the Greater Toronto Area.

We are building a rental platform by acquiring unsold and underutilized condominium inventory at scale—bringing institutional-quality ownership and management to a highly fragmented market.

The strategy capitalizes on structural imbalances in the Canadian housing market, where new supply remains constrained and existing inventory is inefficiently held. A portion of units are designated as attainable rentals for workforce households, aligning the platform with municipal housing policy objectives.

Housing Platform

Our platform is built to acquire, integrate, and operate residential units at institutional scale.

The model is designed for speed to deployment, operational consistency, and the capacity to execute across multiple transactions simultaneously. We apply standardized underwriting, centralized property management, and technology-enabled operations across the portfolio.

The platform partners with developers, lenders, and government stakeholders to source inventory efficiently. Where applicable, a portion of units are designated as attainable rentals, supporting municipal housing objectives while maintaining portfolio returns.